After more than 20 years of development, my country's industrial robots have taken shape. At present, my country has produced some key components of robots and developed industrial robots such as arc welding, spot welding, palletizing, assembly, handling, injection molding, stamping, and painting. A number of domestic industrial robots have served the production lines of many domestic enterprises, a number of research talents in robot technology have also emerged, and some key technologies have reached or are close to the world level.

The construction of robot parks has gradually formed industrial agglomerations

At present, the industrial agglomeration formed by the joint efforts of parks and leading enterprises has become an important feature of the development of my country's robot industry. Local governments around the core links of the robot industry chain such as body manufacturing, system integration, and parts production have led the construction of robot industrial parks with their own characteristics and complementary advantages, gradually forming a highland of technology and capital, with an increasingly reasonable industrial layout and a significantly enhanced radiation and driving effect, attracting a considerable number of projects and enterprises with development prospects to actively join the park.

By the end of 2017, there were about 50 robot towns or industrial parks in China. By the end of 2018, 74 robot industrial parks were under construction or had been completed. Since 2018, the construction of robot parks has been in full swing, helping my country's robot production capacity to continue to expand.

According to my country's administrative and geographical divisions, combined with the actual development foundation and characteristics of the robot industry, the country is divided into six major regions: Beijing-Tianjin-Hebei, Yangtze River Delta, Pearl River Delta, Northeast China, Central China and Western China. After questionnaire surveys and field investigations, the industrial scale benefits, structural levels, innovation capabilities, agglomeration conditions and development environment of the six major robot industry agglomeration areas are comprehensively evaluated, and the industrial development levels of each region are systematically compared. The results show that the Yangtze River Delta region has the strongest foundation in the development of my country's robot industry, and the robot industry in the Pearl River Delta and Beijing-Tianjin-Hebei regions has gradually developed and grown. Although the Northeast region has certain first-mover advantages in the robot industry, the overall performance of the industry has been relatively limited in recent years. The development foundation of the robot industry in the central and western regions is relatively weak, but it has shown considerable latecomer potential.

There are more than 1,000 robot companies in Guangdong and Jiangsu, and the competition is fierce

The strong market demand for industrial robots in China has also brought signs of overheating in the industry. At present, there are more than 20 provinces focusing on the development of the robot industry and more than 40 robot industrial parks. In the past two years, the number of robot companies has rapidly increased from less than 400 to more than 1,000, and there are more than 3,400 companies related to the industrial chain. But most of them are concentrated in the middle and low-end markets.

According to incomplete statistics, as of June 2018, the number of domestic robot-related enterprises reached 7,544, of which Guangdong Province had the largest number of robot manufacturers, reaching 1,508, followed by Jiangsu Province with 1,158, ranking second; other regions such as Shanghai, Zhejiang, Shandong, Beijing, Anhui and Hunan had 706, 604, 572, 283, 280 and 213 respectively.

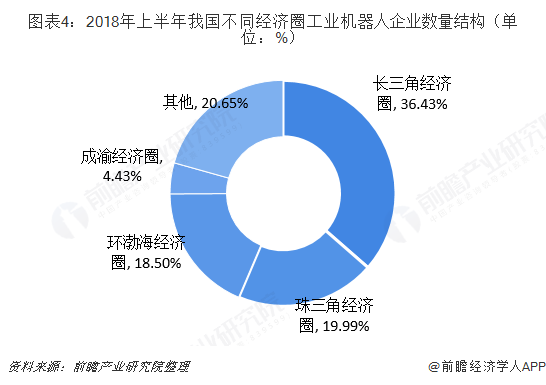

There are 23 provinces and cities with more than 50 companies, 18 with more than 100, and 10 with more than 200 (Henan and Liaoning have joined the 200 club). In terms of regions, the number of robot companies in the Yangtze River Delta Economic Zone reached 2,478, accounting for 36.43% of the total number of robot companies, making it the region with the most concentrated robot companies in China, followed by the Pearl River Delta region.

TOP9 occupies nearly 50% of the market share, and the industry concentration is high.

As my country's robot market is still dominated by foreign brands, the domestic industrial robot industry is relatively weak. Faced with such huge domestic industrial robot market potential, no domestic company has participated in the market to share the dividends brought by the continuous expansion of the market scale.

Comparing the sales of different domestic manufacturers, the domestic manufacturers with better market performance are Efort, Estun, Zhongweixing, Guangzhou Qifan, Siasun and Xinshida. Compared with other local manufacturers, these manufacturers started earlier and now have a certain scale and technical strength. The top 9 occupy nearly 50% of the market share, and the industry concentration is high.

Release time:2023-05-29

Release time:2023-05-29

Reading:903

Reading:903

Back to list

Back to list