II. A market worth hundreds of billions of yuan is ready to take off, and the industry is entering a golden period of development

(I) China is the largest industrial robot market, with a market size of about 30-40 billion yuan

According to the industrial robot sales data released by IFR, China's industrial robot sales reached 154,000 units in 2018, an increase of 10.66% year-on-year, a slight decrease of 1.37% year-on-year, and sales of US$5.42 billion (RMB 37.8 billion). In recent years, the Chinese market has become the largest market for industrial robots, contributing more than 30% of global industrial robot sales. The sales volume in the domestic market has grown rapidly, from 700 units in 2001 to 154,000 units in 2018, with an average annual compound growth rate of 37.3%.

(II) The market of 100 billion yuan will rise, with a CAGR of 22% in the next three years

Compared with developed countries, the density of industrial robots in my country still has a lot of room for improvement. According to data released by IFR, the country with the highest industrial robot density (the number of robots per 10,000 manufacturing employees) in 2018 was Singapore, reaching 831 units/10,000 people, followed by South Korea, reaching 774 units/10,000 people. The industrial robot density of developed countries such as Germany, Japan and the United States is also above 200 units/10,000 people. China is 140 units/10,000 people, slightly higher than the global average. As a manufacturing powerhouse, my country still has a lot of room for improvement in the density of industrial robots compared with other developed countries. With the steady implementation of the national strategy of "Made in China 2025", the pace of transformation and upgrading of the domestic manufacturing industry will gradually accelerate, and the density of robots will increase significantly. Assuming that it reaches the level of Japan, my country's industrial robots will be a market worth hundreds of billions of yuan, with huge potential for future development.

The demographic dividend is gradually disappearing, accelerating the trend of "robots replacing people". An important reason why China has maintained rapid development in the past few decades is the demographic dividend. Due to the relatively low labor costs brought by the huge population, China's labor-intensive industries have comparative advantages in the world. However, as China gradually enters an aging society, China's demographic dividend is disappearing rapidly and labor costs are rising rapidly.

From the perspective of the labor force population structure, the proportion of my country's 15-64-year-old labor force has been declining year by year since 2009, reaching 71.2% in 2018, a decrease of 0.62% from 2017. The "Blue Book" released by the Chinese Academy of Social Sciences pointed out that my country's working-age population will decrease by 7.9 million people per year in the decade after 2020, and the decline will continue to increase in the future. From the perspective of labor costs in the manufacturing industry, the average salary of employees in my country's manufacturing industry has continued to increase. As of 2018, the average annual salary of manufacturing employees reached 72,088 yuan, an increase of 11.85% year-on-year, and labor costs have continued to rise. The rapid decline in the labor force and the sharp increase in labor costs pose a serious threat to the survival of manufacturing companies,This forces enterprises to reduce production costs and improve production efficiency.

According to IFR data, the global sales of industrial robots in 2014 and 2018 were 229,000 and 42,200 units respectively, with corresponding sales of US$10.7 billion and US$16.5 billion respectively. From this, it can be calculated that the average selling price of industrial robots has dropped from US$47,000 per unit in 2014 to US$39,000 per unit in 2018, a decrease of 16.2%. While the average selling price continues to decrease, the performance of robots is constantly increasing. Therefore, it is very attractive for enterprises to replace people with machines.

Through this calculation, it can be seen that in the next three years from 2020 to 2022, the domestic industrial robot market will have a market space of 108.6 billion yuan, with a CAGR of 22%.

(III) Reviewing Japan, the domestic robot industry will enter a stable growth period sooner

The development of industrial robots in Japan has mainly gone through the following four stages:

Initial accumulation period (1967-1970):

In 1967, Kawasaki Heavy Industries introduced robots and related technologies from the world's first robot company, Unimation, and established a production workshop. The following year, the first Kawasaki industrial robot was successfully developed. In the late 1960s, Japan's annual economic growth rate was as high as 11%, mainly driven by the manufacturing industry, and the number of employees continued to increase.

Starting Development Period (1970-1980)

After a short initial development period, Japan’s industrial robot industry ushered in a period of explosive growth. According to data released by industry statistics agencies, Japan’s annual output of industrial robots was about 1,350 units in 1970, and 10 years later in 1980, this number increased to 19,843 units, with an average annual growth rate of more than 30%.

Explosive Growth Period (1980-1990) After entering the 1980s, Japan's population growth slowed down. Japan, which was in a period of rapid economic growth, had a serious shortage of labor, the number of people employed in the manufacturing industry also tended to decline, and the labor cost also increased significantly. At this time, the Japanese government introduced a series of policies to guide the development of the robot industry, and enterprises further increased their R&D investment in industrial robots. Industrial robots began to be popularized in various fields in Japan. In this process, the large-scale application of industrial robots effectively solved the problem of labor shortage, greatly reduced production costs, and effectively improved labor productivity and product quality. The popularization of robots enabled Japan to maintain the continuous growth of the total output value of the manufacturing industry. From 1980 to 1982, Japan's annual robot production had increased to 24,782 units, and the number of advanced robots accounted for about 56% of the world's total, while the number of advanced robots in the United States at that time was only one-fifth of that in Japan. In the mid-1980s, Japan had become a veritable "robot kingdom" with a robot stock of more than 100,000 units.

Mature and stable period (1990 to present)

After 1990, Japan's industrial robot industry began to enter a period of stable growth. At this time, the demand structure of the robot market changed, and the domestic industrial robot market in Japan became saturated. Under the guidance of the government, Japanese machine manufacturers began to actively explore overseas markets. By 2012, robot sales in the Japanese domestic market accounted for only 30% of the total annual sales. A large number of Japanese industrial robots began to be exported overseas, and Asia became the largest overseas market for Japanese industrial robots.

Since its inception in 2000, China’s robot industry has gone through the following stages: inception, rapid development, decline and adjustment. It took only 13 and 16 years to surpass other industries, becoming the world’s largest industrial robot sales and ownership in 2013 and 2016 respectively:

From 2000 to 2009, the industry started. China’s automobile industry was relatively backward in manufacturing, and 3C electronics began to undertake the third global capacity transfer (from Japan, South Korea, and Taiwan to mainland China), with a low degree of automation.Foreign robot giants generally entered mainland China around 2000, and sold thousands of industrial robots each year, which were basically foreign brands and mainly used in the automotive industry. Domestic companies mainly act as system integrators and agents for foreign companies, and very few companies, such as Shenyang Siasun, have developed their own robot bodies.

2010-2017, rapid development. Local policy subsidies were intensively introduced, prices fell, and the automation market of the automotive 3C electronics industry exploded. The industry experienced several years of rapid growth, with an average annual compound growth rate of 52%.

2018 to date, industrial adjustment. Subsidies directly facing the market have been greatly reduced, coupled with the slowdown in fixed asset investment in automobiles and 3C electronics, sluggish demand, and industrial decline and adjustment, the market is accelerating to bottom out.

Looking back at the development history of Japan's robot industry, the shortage of labor resources, rising labor costs, adjustment of industrial demand structure and active guidance of government policies in the 1980s made Japan's robot industry experience a golden period of development for 20 years. These backgrounds are similar to the demographic dividend inflection point faced by the domestic robot industry in 2010 and the continuous increase in the average salary of manufacturing employees. After another 7 years of rapid development, China's industrial robot industry has entered an industrial adjustment. It took only 17 years for China's industrial robot industry to go through Japan's 23-year journey. After the industry hits the bottom this time, it will quickly enter a mature and stable stage and maintain steady growth under the stimulation of downstream demand growth.

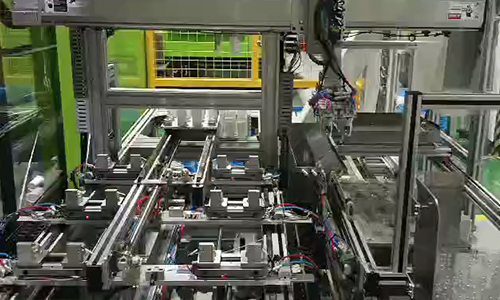

3. The domestic industrial chain is gradually improving, and import substitution is expected to accelerate. (i) The industrial robot industry chain can be divided into three links: parts, body, and system integration. The industrial robot industry chain includes three parts: upstream core parts, midstream robot body, and downstream integrated applications. The upstream is the manufacturer of parts such as controllers, servo motors, reducers, sensors, and end effectors. Controllers, servo motors, and reducers are the three core parts of industrial robots. The midstream is the body manufacturer, which is responsible for the assembly and integration of the industrial robot body, that is, the base and actuators, including arms, wrists, etc. Some robot bodies also include walking structures. The downstream is the integrated application provider, which is responsible for targeted system integration and software secondary development of industrial robots according to different application scenarios and uses.

Among them, the key link of the industrial robot industry chain is the upstream core components, which account for most of the cost and profit of the industrial robot. It is also the core and difficulty of the technology and the most important part affecting the performance of the robot. The cost of the three core components, controller, servo motor and reducer, accounts for about 70% of the total cost of industrial robots, of which the reducer accounts for about 35% of the cost of the whole machine, the servo accounts for about 20% of the cost of the whole machine, the controller accounts for about 15% of the cost of the whole machine, and the body and other parts only account for 15% and 15% of the whole machine respectively.

(II) Analysis of the competition map of each link in the industrial chain shows that the localization rate is not high

1. Core components - controller: the brain of the industrial robot, bound to the body

As one of the three major components of an industrial robot, the controller is the brain of the industrial robot and has a decisive influence on the performance of the robot.Industrial robot controllers mainly control the robot's motion position, posture and trajectory in the workspace, the operation sequence and the time of the action.

The domestic industrial robot controller market is mostly occupied by Japanese and European and American brands. Due to the "nerve center" status and relatively low threshold of the controller, mature robot manufacturers generally develop it themselves to ensure stability and maintain the technical system. Therefore, the binding effect between the controller and the robot body is strong, and the market share is basically consistent with the robot body. Mainstream robot manufacturers all have their own control systems to match them, and the domestic industrial robot controller market is mostly occupied by Japanese and European and American brands. The four major families represented by FANUC, Yaskawa, Kuka and ABB generally adopt the production model of self-production and self-use. Their share of the Chinese industrial robot controller market is basically consistent with their share of the robot body market, reaching more than 40%.

The controller hardware chips rely on imports, and the software algorithm gap is large. After years of accumulation, the controller hardware solutions of domestic manufacturers have reached international standards, but the materials are limited, the underlying chips rely on imports, and there is no research and development foundation in China. In terms of software, international industrial robot brands started earlier and have rich experience and data. Domestic brands still have some gaps in stability, response speed, ease of use, etc.

2. Core components - servo: the mid-to-high-end market is monopolized by foreign companies

The servo system is a feedback control system used to accurately follow or reproduce a process. It consists of three parts: servo drive, servo motor, and encoder. It is the main power source of industrial robots. Servo motor refers to the engine that controls the operation of mechanical components in the servo system. The servo motor can control speed and position accuracy very accurately, and can convert voltage signals into torque and speed to drive the control object.

According to the statistics and forecasts of Servo & Motion Control, the servo market size was 9.38 billion yuan at the end of 2018, a year-on-year increase of 4.7%. Compared with the end of 2015, the compound annual growth rate reached 13.2%, and it is expected that the Chinese servo market will exceed 10 billion yuan in 2021. Servo motors play an important role in industrial automation and are widely used in electronic equipment manufacturing, industrial robots, machine tools, packaging machinery, printing machinery and other fields. According to the statistics of Servo & Motion Control, robots accounted for 9.3% of the downstream applications of servo systems in 2018.

At present, the mid-to-high-end servo motor market in my country is mainly monopolized by foreign companies, and imported products account for more than 70% of the industrial robot servo market in my country, and they mainly come from Japan, Europe and the United States. Among them, Japanese products take the first place with a market share of over 50%. Its famous brands include Yaskawa, Panasonic, Mitsubishi Electric, Sanyo, etc. These are all old Japanese industrial automation equipment manufacturers with comprehensive technology. Their products have obtained a stable and continuous customer base with good performance-price ratio and high reliability. European and American brand products represented by Siemens, Schneider, Bosch Rexroth, etc. have high overload capacity, good dynamic response, strong driver openness, but are expensive, large in size and weight, and are more competitive in high-end equipment and production lines.

Domestic servo motor technology is relatively backward, and products are mainly in the low-end and medium-end fields. At present, Chinese enterprises can achieve large-scale mass production in the low-end and medium-end servo field, and meet the needs of small and medium-sized and economical users with the advantage of cost-effectiveness. For example, the servo drives and motor products of Inovance Technology, Estun, INVT, Huazhong CNC, Guangzhou CNC and other enterprises have entered the mass production stage one after another.

3、Core components - reducers: the highest technical barriers and the lowest localization rate

Precision reducers are the most important components of industrial robots. The core components of industrial robot movement, the "joints", are made up of them. Different reducer products are used for each joint. Reducers are transmission components composed of multiple gears. They use the meshing of gears to change the motor speed, torque and load capacity, and can also achieve precision control. Industrial robots have extremely high requirements for the accuracy, load and life of reducers. Its technical barriers are the highest among the core components of industrial robots, and it is the core component with the highest degree of influence on the performance of the industrial robot itself.

Industrial robots generally use RV reducers and harmonic reducers, among which RV (Rotate Vector) reducers are composed of a planetary gear reducer in the front stage and a cycloid pinwheel reducer in the back stage. Among them, harmonic reducers are a type of gear reducers.

The manufacturing of precision reducers has strict requirements on materials, equipment, processes and other aspects, which leads to extremely high investment and technical barriers. Because of this, the current global industrial robot reducer market is an oligopoly with a high degree of industry concentration. Among them, Japan's Nabtesco is a world giant in the production of RV reducers, accounting for about 60% of the global reducer market share. In the field of medium/heavy load industrial robots, its RV reducer products have a global RV reducer market share of more than 90%. Harmonic has an absolute advantage in the field of harmonic reducers, accounting for about 15% of the global reducer market share. In addition, Sumitomo also has a 10% market share, and its products include FINECYCLO series zero-backlash precision cycloid reducers. The global reducer market presents a highly concentrated situation dominated by Japanese companies.

Compared with Japanese companies, domestic companies have entered the field of reducers for a relatively short time, and the technical level of domestic manufacturers still needs to be improved. GGII data shows that more than 70% of the market share of domestic robot reducers is monopolized by foreign-funded reducer companies, and the localization rate is less than 30%. In the process of localization of reducers, although many reducer manufacturers such as Suzhou Green, Lai Fu, Nantong Zhenkang, Qinchuan Machine Tool, and Zhongda Lide have achieved mass production and market acceptance has increased year by year, there is still a certain gap with the two major Japanese companies, mainly reflected in the comprehensive performance of the products, such as accuracy, stability and service life.

4、Body: Hardware technology is becoming mature, and domestic substitution is expected to accelerate

Industrial robot bodies can be divided into rectangular coordinate type, SCARA type, multi-joint type, parallel type, etc. according to the coordinate form. Among various types of industrial robots, multi-joint type and SCARA type are the largest in use and have the widest application fields. From the perspective of market structure, multi-joint robots and SCARA robots account for the main share of industrial robot sales, among which multi-joint robots account for 59.64% of sales and SCARA robots account for 21.48% of sales.

The hardware technology of robot bodies has become mature, mainly in the optimization of structure and the improvement of user experience. Foreign capital still monopolizes the high-end market, and the localization rate of mid- and low-end products is increasing. FANUC, ABB, Yaskawa, and Kuka are the four major robot families in the world, with a combined market share of more than 50%.

5. System Integration: The industry is relatively fragmented

Industrial robot system integration is responsible for targeted secondary development of the robot body according to different application scenarios and purposes, and supporting peripheral equipment to achieve industrial application. Compared with upstream core components and midstream bodies, downstream system integration has the lowest technical barriers and has the competitive advantage of localized services. Domestic companies have flocked into the downstream system integration field. According to MIR databank statistics, by the end of 2017, the number of industrial robot system integrators exceeded 3,000, while in September 2014, the number did not exceed 500, and the competition was extremely fierce. In addition, the scale of domestic integrators is not large. Among the companies, there are no more than 100 companies with revenue exceeding 100 million yuan, and the system integration of most companies does not exceed 30 million yuan. Among them, enterprises with revenue exceeding RMB 300 million are mainly concentrated in the field of automotive welding integration, and the overall market competition pattern is relatively scattered.

MIR Databank conducted an industry coverage analysis on 5,627 manufacturers out of 7,888 system integrators, of which 1,906 covered the automotive industry, accounting for 33.9%; 698 covered the food and beverage industry, accounting for 12.4%; 588 covered the home appliance industry, accounting for 10.4%; 413 covered the medical industry, accounting for 7.3%; and 571 covered the consumer electronics industry, accounting for 10.1% (some manufacturers cover multiple industries).

The reasons for this phenomenon come from the characteristics of the industry:

(1) System integrators are order-based enterprises with people at the core. The core competitiveness of system integrators is talent, so system integrators are actually light-asset order-based engineering service providers. Their core competitive advantage is the experience of sales staff, project engineers and installation and commissioning personnel. They do not have much core technology or fixed assets, so it is difficult for system integrators to expand their scale through mergers and acquisitions.

(2) Almost every project is non-standard, and projects cannot be completely copied, and cannot be simply copied to increase volume.

(3) System integration projects usually adopt the "3331" payment model, that is, 30% of the funds are paid after the drawings are reviewed, after the delivery is completed, and after the installation and commissioning, and the remaining 10% is the warranty deposit, which is generally obtained after the production line has been running smoothly for 1-2 years. According to this payment process, system integrators usually need to advance funds for operation, which limits the number and scale of projects they can implement at the same time;

(4) Compared with the core components and body business of robots, most system integration is a field with low technical barriers and it is easier to enter the industry. In the context of the explosive growth of the market in recent years, a large number of small and medium-sized system integrators have been born, and low-end duplication of construction has made the market more fragmented.

(III) Technological progress, increased localization rate, and greater flexibility in core components and bodies. At present, the localization rate of industrial robot bodies and core components in my country is relatively low. More than 70% of the reducer market, servo motor market, control system market and body market in my country are occupied by overseas brands. The key component industry is controlled by foreign manufacturers, which makes the production cost of domestic automation unit products and automation equipment high, weakening the comprehensive competitiveness of domestic manufacturers. In addition, the market share is still relatively scattered and at the lower end of the value chain. In areas such as automobiles and 3C that require relatively high precision and stability, most of the market share is occupied by foreign brands. Most of my country's bodies are concentrated in relatively low-end areas such as stacking, loading and unloading, and handling. According to MIR Databank data, the sales volume of my country's own robot brands accounted for about 27.72% in 2018. According to data from the China Robot Industry Alliance, in the main downstream application fields of electrical and electronic equipment and equipment manufacturing and the automotive industry, domestic brands account for 30.1% and 13.8% respectively, both of which have great room for improvement.

Domestic robot companies have gradually strengthened their technological research and development and innovation capabilities. As my country's robot market continues to expand, some companies have taken downstream system integration as a starting point, continuously improved their technological innovation capabilities, and gradually carried out mid- and upper-stream technological research and development and product development, achieving impressive results, and the technological gap between China and foreign countries has continued to narrow. In the future, as my country's industrial robot technology continues to strengthen, the localization rate is expected to gradually increase.

IV. Summary of progress of key enterprises and investment suggestions

(I) Investment suggestions

With the recovery of the industrial robot industry, sales have entered an upward channel. Domestic robot companies are more flexible under the background of import substitution. We give the industrial robot industry a "recommended" investment rating, and recommend Estun. We suggest paying attention to Tosda, Robot, New Step, Zhongda Lide, etc.

Release time:2023-05-29

Release time:2023-05-29

Reading:871

Reading:871

Back to list

Back to list